Dear Valued Customer,

As per Section 58 and Section 63 of the Customs Act of Bhutan 2017, it is mandatory for all goods being imported into or exported from Bhutan to be declared to the Department of Customs. In light of this, we kindly urge our valued customer to update your TPN (Taxpayer Number) to declare your goods and for those who do not have TPN, we request to register for TPN number in RAMIS at https://ramis.drc.gov.bt/appUserLogin.html at your earliest convenience.

Thank you for your prompt attention to this matter. Should you require any assistance or have any questions, please feel free to contact us.

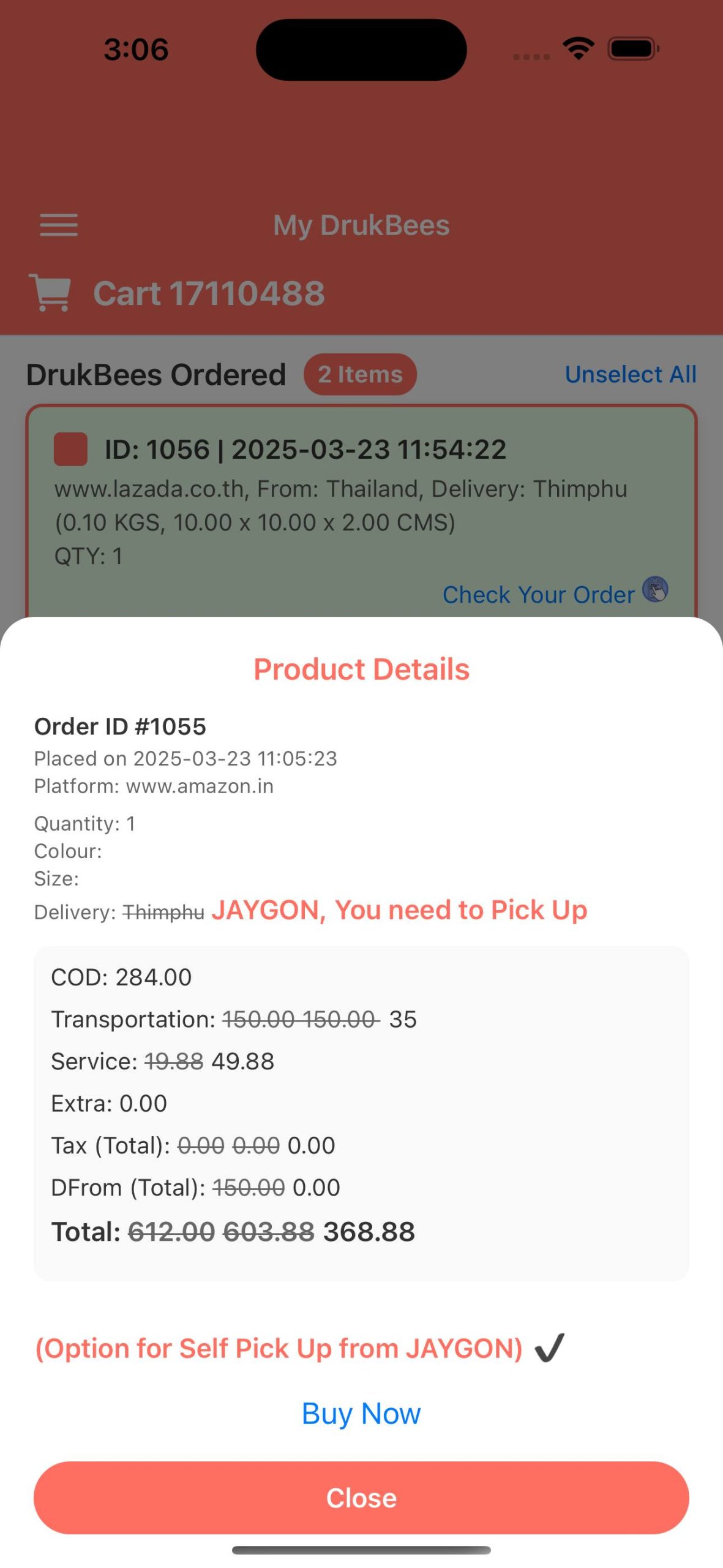

This is with immediate effect, and would like to inform our customers, that this change will also have the following changes in our charges as follows:

Important Update on Online Goods Declaration and Associated Fees

Dear Valued Client,

As per the letter No: RTG/ICP/CUS-06/2024-25/40 dated on 17th January 2025, we are notify that as per Section 58 and Section 63 of the Customs Act of Bhutan, it is mandatory for all online goods to be declared individually, regardless of whether they are taxable or non-taxable.

Please take note of the following important updates regarding the declaration process and associated fees:

- For Taxable Goods:

- A declaration processing fee of Nu. 100/- will be paid to the customs.

- A clearing fee of Nu. 200/- will be paid to the clearing agent.

- The applicable tax amount will be calculated based on the value of the goods, and this cost will be borne by the client.

- For Non-Taxable Goods:

- A declaration processing fee of Nu. 100/- will be paid to the customs.

- A clearing fee of Nu. 100/- will be paid to the clearing agent.

- No tax will be charged for non-taxable goods.

Please be informed that the DrukBees service charges and transportation charges will remain unchanged.

Additionally, we are in the process of updating the DrukBees NOTIFICATION system to reflect these changes, and we kindly request your cooperation in adhering to the updated guidelines.

Should you have any questions or need further clarification, please feel free to contact us. We appreciate your understanding and cooperation.

Leave a Reply